What is an ETF in the stock market

What is an ETF in the stock market. What Exactly is an ETF? Have you ever felt overwhelmed by the stock market? You hear whispers of hot stocks and investment opportunities, but it all seems complex and confusing.

What is an ETF in the stock market

What if there was a way to invest in a variety of companies without picking each one yourself? Enter the world of ETFs, a simple and powerful tool that can transform your approach to investing.

Demystifying the ETF: A Basket Full of Opportunities

Imagine a basket filled with different fruits. An ETF is similar, but instead of fruits, it holds a collection of investments like stocks, bonds, or even commodities (like gold or oil). This basket is traded on a stock exchange, just like individual company stocks. But there’s a twist: the contents of the basket are predefined, often following a specific theme or mirroring a market index.

Takeaway: ETFs offer a way to invest in a variety of assets without having to research and choose individual companies.

How Do ETFs Work? Unveiling the Magic Behind the Basket

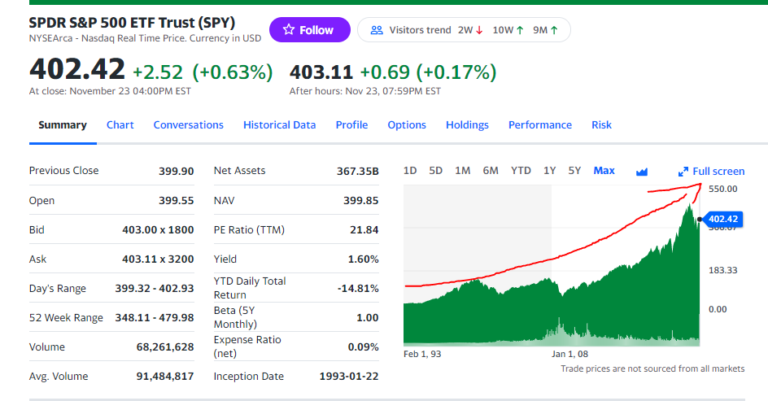

So, how does this basket of investments translate into real-world gains? Let’s take a popular ETF that tracks the S&P 500 index, a benchmark that includes 500 of the largest US companies. When you buy a share of this ETF, you’re essentially buying a tiny slice of ownership in each of those 500 companies. The ETF automatically adjusts its holdings to reflect the index, so you don’t have to worry about picking and choosing individual stocks.

Takeaway: ETFs offer a convenient way to gain exposure to a specific market segment or index.

Why Choose ETFs? Unveiling the Advantages

Now that you understand the basics, let’s explore the reasons why ETFs have become a favorite among investors of all levels. Here are some key advantages:

- Diversification: As mentioned earlier, ETFs hold a basket of investments. This built-in diversification helps spread your risk. Imagine one company in your basket has a bad quarter. The overall impact on your investment is lessened by the performance of the other companies.

- Lower Cost: Compared to mutual funds (another pooled investment option), ETFs often come with lower fees. This means more of your money goes towards potential growth.

- Flexibility: Just like individual stocks, ETFs can be bought and sold throughout the trading day, offering you greater control over your investments.

- Transparency: Most ETFs publicly disclose their holdings, allowing you to understand what your investment is tracking.

Takeaway: ETFs offer a combination of diversification, lower costs, flexibility, and transparency, making them an attractive investment option.

Picking the Perfect ETF: A Matchmaker for Your Portfolio

With a vast array of ETFs available, choosing the right one can seem daunting. But worry not! Here are some factors to consider:

- Investment Objective: What are your investment goals? Are you looking for long-term growth, income generation, or a mix of both? Choose an ETF that aligns with your objectives.

- Underlying Assets: What type of assets do you want exposure to? Stocks, bonds, commodities? Consider your risk tolerance and choose an ETF with holdings that match your preferences.

- Expense Ratio: As mentioned earlier, ETFs come with fees. Compare expense ratios of different ETFs to find one that offers good value for your money.

Takeaway: Consider your investment goals, risk tolerance, and fees when selecting an ETF to add to your portfolio.

Taking Flight with ETFs: Soaring Towards Your Investment Goals

Now that you’ve been equipped with the knowledge of ETFs, it’s time to take action! Remember, ETFs are a powerful tool, but they are not without risks. Do your research, understand your risk tolerance, and consult a financial advisor if needed. With ETFs by your side, you can navigate the exciting world of investing and soar towards your financial goals.

You May Like: The Math for Buying a Home No Longer Works: A Sobering Reality Check