What They Don’t Teach In School About Money

Many people go to school for education, high school and college. But there are never taught about money. How do I know? I went to college. 🙁

Assets and Liabilities, these terms I never knew they existed until I was old enough beyond my years.

Assets are things that generate you income. People use different terms to describe assets. Some of the most well known are: assets are things that pays you or assets are things that bring you cash flow, or assets are thing that put money in your pockets or assets are things that have financial value.

Liabilities are thing that degenerate or decrease your income. People use different terms to describe liabilities. Some of these terms are: liabilities are thing that take money out of your pockets, or liabilities are things that do not pays you or liabilities are things that decrease in value.

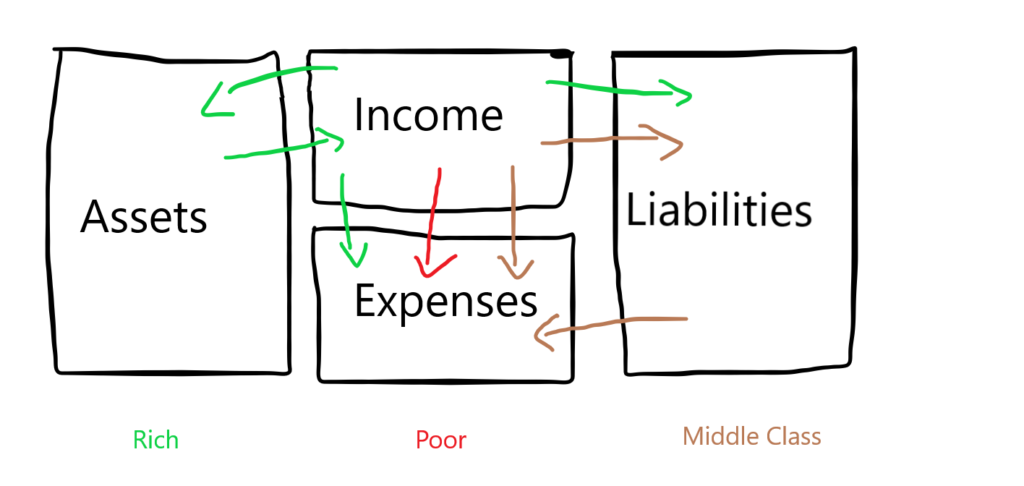

Poor People , middle class people and rich people use money differently.

Poor people use their income on their day to day expenses. They don’t buy that many liabilities since they can’t afford it.

Middle class people use their income on their day to day expenses. But they also use it to buy liabilities.

Rich people use their high income to buy assets. These assets allow them to buy more assets that bring them income. And from these assets they use a portion for their day to day expenses. also they use a portion to buy calculated risk liabilities .