Covered call ETFs explained – High dividend passive income

Covered call ETFs are suppose to be low risk income enhancing strategy and it’s main purpose is to get high dividend income in a safe and consistent way. Keep reading and you’ll see the benefits.

Quick overview of few things first.

ETFs

ETF means exchange trade funds, and they are just group of stocks you can invest in. instead of investing in a single stock, you just invest in a group of stocks, that’s it.

Financial derivatives

Derivative is an instrument whose value is derived from the value of one or more underlying asset. Such as stocks, stock indices, bonds, currency, previous metals, commodities, etc. examples of financial derivatives are options, futures, forwards, swaps.

Options

Options are financial derivatives that give buyers the right, but not the obligation to buy or sell an underlying asset at an agree upon price.

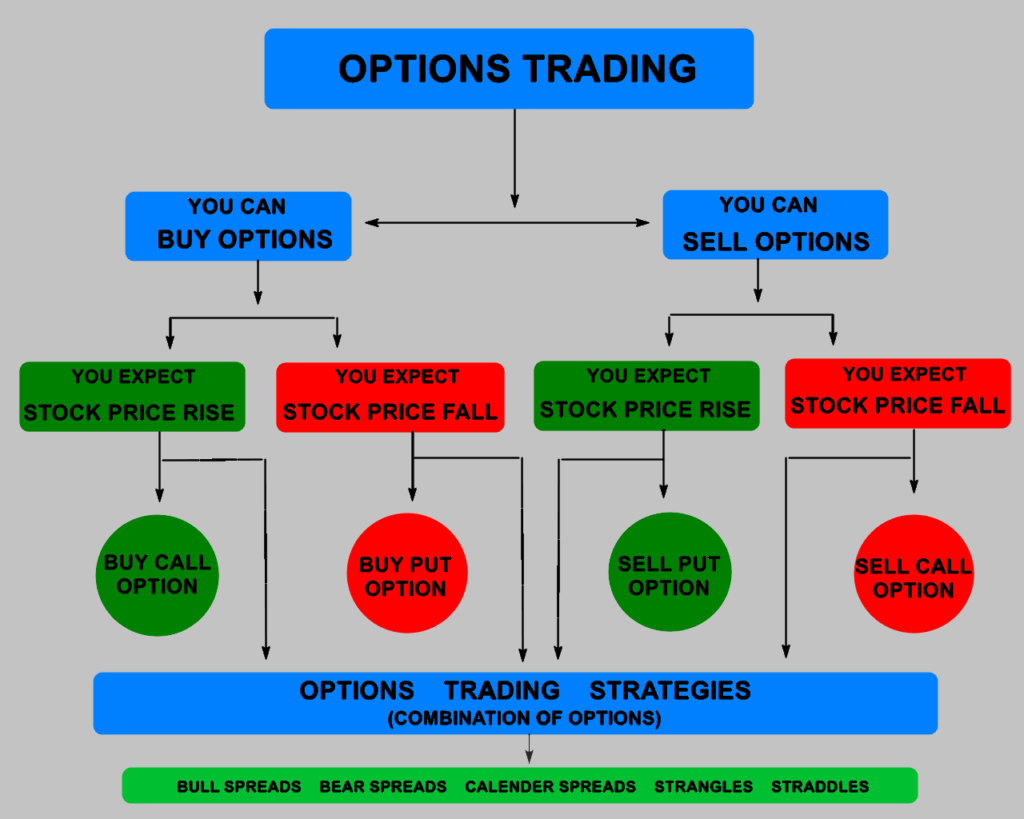

You can either Sell a call option or a put option.

you can either buy a call option or a put option.

Call options

Call option – is an option to buy assets at an agreed price on or before a particular date in the future. because is an option you are not obligated to buy, you have the option to buy if you want to. That’s it.

Options Premium

Options premium is the amount of money that investors pay for a call or pull option.

You earn/get premiums by selling covered calls. And they are classified as capital gains. So there are tax efficient.

You pay premiums by buying call options

ok after the quick overview let’s continue.

Covered call ETFs

Covered call ETFs are suppose to be low risk income enhancing strategy and it’s main purpose is to get high dividend income in a safe and consistent way.

They are name covered call because you own the shares. In case the option gets exercised you’ll be able to fulfill the transaction.

Explanation

Without added risk, call options are use by covered call ETFs to increase the dividend yield.

Therefore, if there are two ETFs with similar group of stocks. One without covered call and another with covered call. The one with covered call will yield higher interest.

This is already sounding too complicated!

True it’s complicated

The good news is that since they are covered call ETFs, you just need to buy the eft, everything else is done by the company that is managing the covered call ETFs.

Some of the benefits of owning a covered call ETF is

- Passive income.

- Since is a ETF you are automatically diversifying aka minimizing your risk.

- Higher Yield than a regular dividend ETFs or index ETFs when it comes to cashflow.

- More consistent and safer dividend income that regular dividend stock or index ETF

- You can have different type of covered call ETFs, base on sector, countries, etc.

- Good performance with bear market and volatility. So, we welcome market crashes.

- When the stock market crashes the price of premium goes up 🙂 aka more cashflow if already own shares.

- You have two income stream instead of one. The option premiums and the dividends.

- As long as there are options being trade there will be option premiums to be made.

- Management fee is till low.

- Tax efficient income, Premiums call are classified as capital gains. great for taxable accounts.

Alright, so covered call ETFs are intended for people that wants to buy and hold. Covered call ETFs are suppose to be low risk income enhancing strategy and it’s main purpose is to get high dividend income in a safe and consistent way without the add risk of leverage.

Now, start and adjust as you go.