High Yield dividend ETF – Covered call ETFs and Buy-write

Cashflow investment, ETFs comparison, how do they generate income and how do buy-write options works.

This is not financial advice, these are opinions base on my understanding.

QYLD – Global X NASDAQ 100 Covered Call ETF and XYLD – Global X S&P 500 Covered Call ETF. Both use the same strategy.

It appears to me that it’s purpose is high cashflow b/c high yield and good price performance. The dividend yields may varies usually anywhere from 7.5% to 12%. So you may want to forget about dividend growth and price appreciation. This is all about High cash flow.

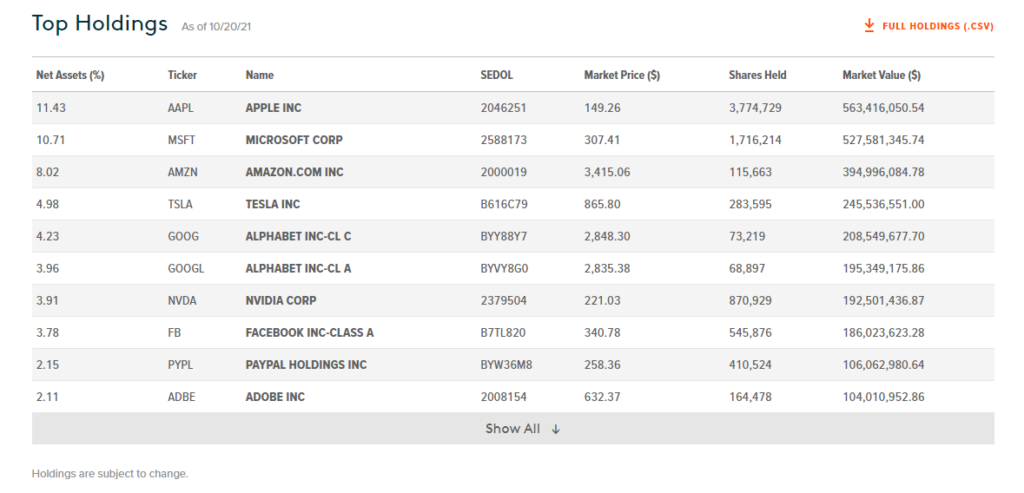

From globalxetfs website

So they buy stocks base on the Nasdaq 100 index. You can recognize some of the top holdings.

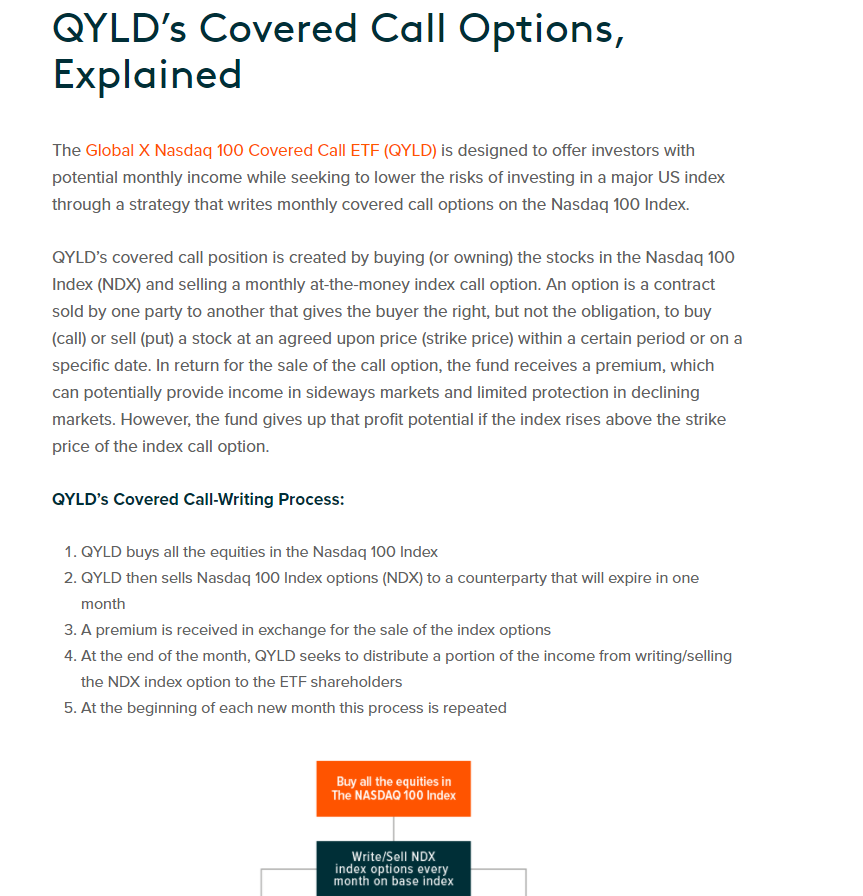

What QYLD does they buy the 100 underlying assets of the Nasdaq 100 index. Since now they own the asset, they can put a monthly covered call option that may sell the assets at the money.

At the money means that the option strike price is identical to the current market price of the underlying asset. Example if x stock is trading at a current price of $100 a share and a x call option has a strike price of $100 then the call option is at the money.

So, one month from now if the covered call is sell at $100, we make the expected cashflow. If it sell out of the money lets say $105, you still made the income that you will had made at $100 but you lose the the capital appreciation of $5, therefore, you generated less income. Still good either way.

Things to notice, either way you get pay twice. The premiums and the dividends. Of course we can’t never guarantee the dividends but so far they have being paying it.

Now, if instead, one month from now the price goes down to $95, then the buyer won’t buy anything. Because he has the right but not the obligation to buy. still kind of a good thing in a way b/c you get to keep the premium that was paid , you also keep your shares although they are price at $95 now.

But get this! unless I am missing something here. We are suppose to buy low and sell high. Since the price now is $95, we get to buy more QYLD shares! 🙂

This sounds too good to be true. What’s the catch?

Well, the catch is that your gains are limited. The same example we gave the price went from $100 to $105, so the buyer earn $5. But what if it went from $100 to $150. that a $50 gain to the buyers. Of course you still get your dividend and premium.

If the catch were to happens, you may want not to forget this. And why risk management is important.

And This show the second catch. Same example, what if the price goes down from $100 down to $50. Ouch! The Buyer doesn’t buy and the price of our share now is 50$. Once again of course you still get the dividend and premium.

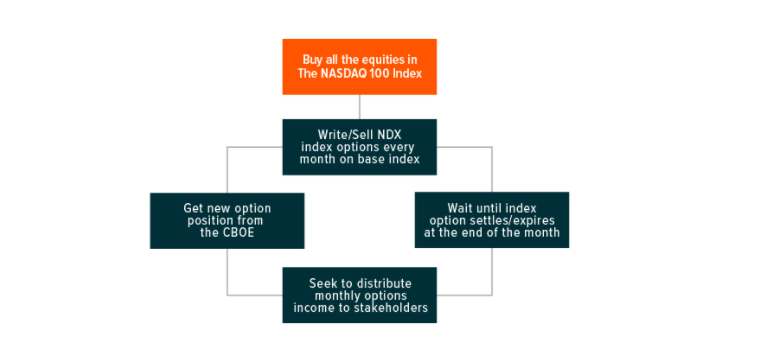

Here is the Diagram, they do these every single month.

XYLD – Global X S&P 500 Covered Call ETF has the same strategy, but instead of using 100 companies they are using 500. Therefore, I don’t see a reason to go over them again. Tips, pay attention to the Dividend yield and PE ration. Some people say buy low and sell high. That’s it.

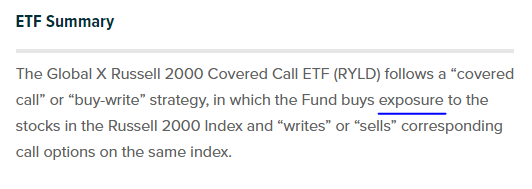

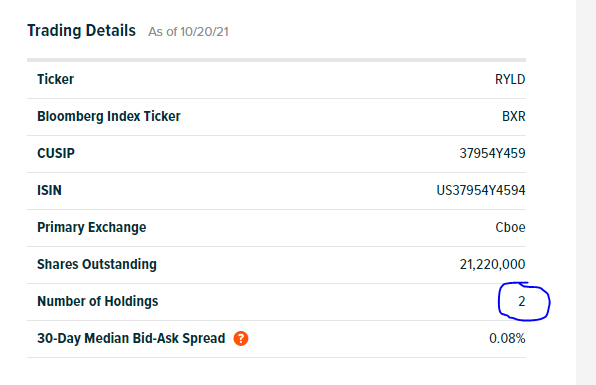

RYLD – Global X Russell 2000 Covered Call ETF. Use kind of the same strategy but with a just a few holdings.

Instead of buying the whole 2000 underlying assets, they just buy exposure to a few holdings.

The holdings are through VTWO. So they own a ETF that own another ETF.

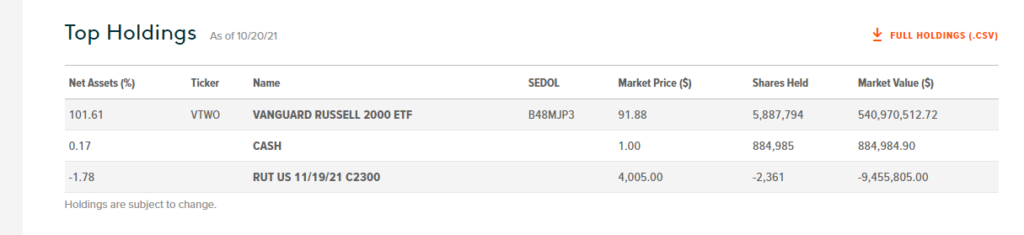

What’s a Buy-write?

A buy-write purpose is to generate income from premiums. An investor buys a underlying asset. like a stock. with options available on it. Key here is options in plural. Also at the same time sells (write) a call option on that underlying asset.

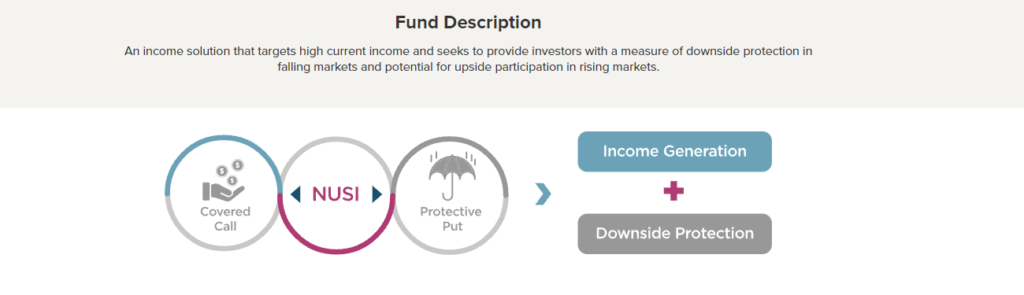

This bring us to NUSI

NUSI – Nationwide Risk-Managed Income ETF , it tracks the NASDA 100 too.

From nationwidefinancial website

Just like QYLD and XYLD this is for for High cash flow and just like them it appears to me that it’s a kind of replacement for bonds. Since bonds interest being so low for the past years.

There are a few differences though. The difference is that NUSI strike price is not at the money. This means the we might get some capital appreciation gains.

Another difference is that they use two options instead of one. They buy a the covered call option the same as before and at the same time they also put a sell options aka stop lost just in case the price goes down.

Same example as before with the $100. if the price where to fall down from $100 to $50, but since NUSI put Sell Options of let’s say $90. This means that the stop lose protected our account and we only lose $10, because the shares were sold at $90.

This downside protection come at a prices though, the Dividend Yield is around 7.5%.

Now, start and adjust as you go.