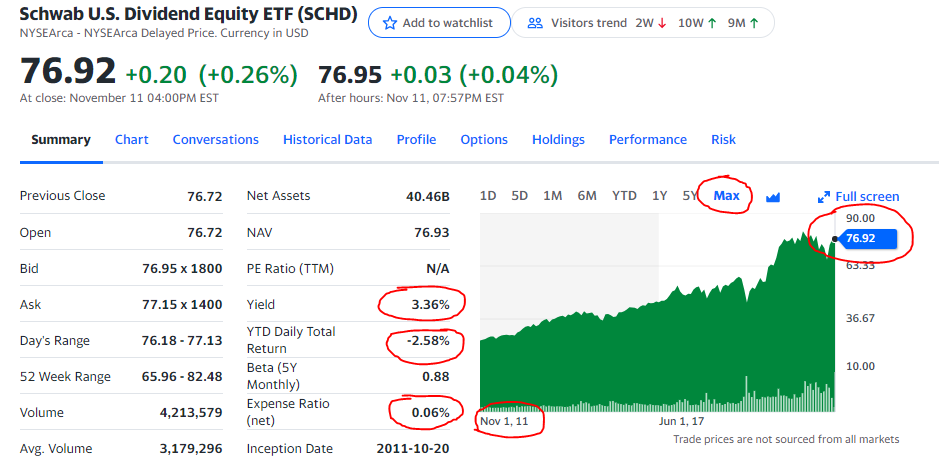

SCHD – Schwab U.S. Dividend Equity ETF – living off dividend income

Is it possible to live off dividend income from just one ETF? Although it is not recommended, the answer is yes. If I could only invest in one ETF then SCHD would be one my top picks that I would look into. This is why…On the below graph you should be able to see some red circles, we are going to go over them. I would keep it simple

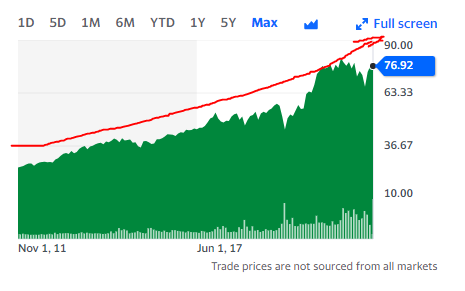

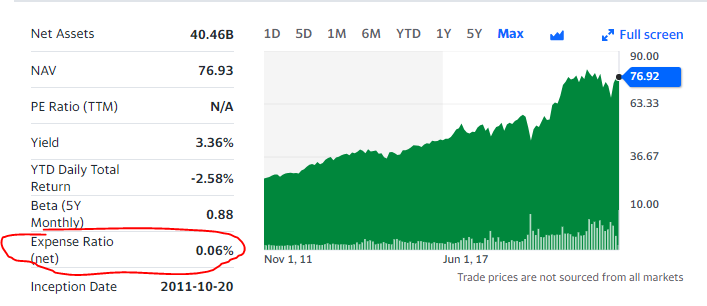

Max days, since inception date , since start and still going strong, when you look at the graph, the price of the ETF is in a uptrend pattern , hence color green, Therefore, The capital has always growth, so we have a growth etf.

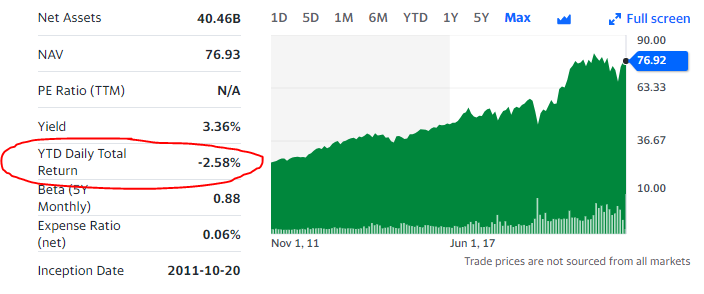

YTD Daily Total return – 2.58%, We have gone through the pandemic, although negative is bad, compare to many other ETF which has around -16% or have being affected way more.

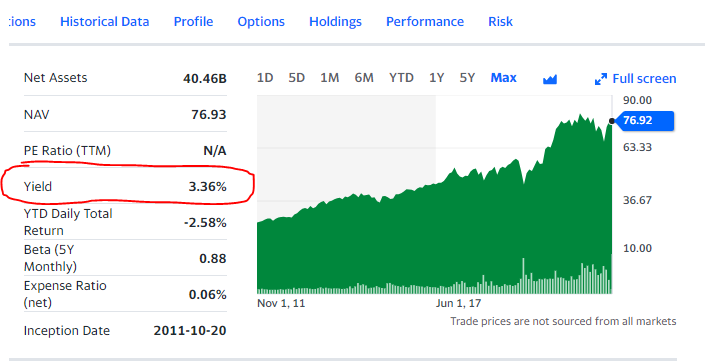

Yield 3.36%, you get a very nice dividend income

Expense ratio is really low 0.06%

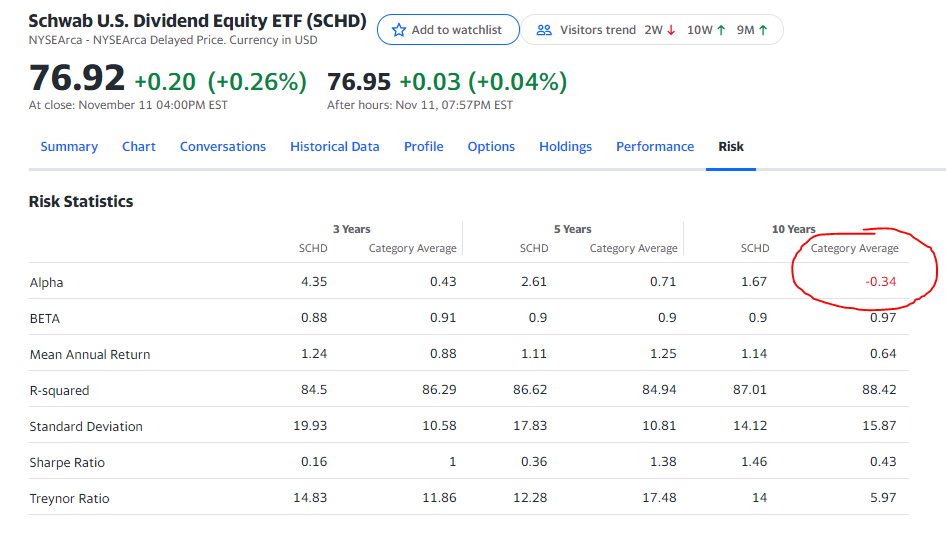

Risk – Even if you don’t now anything about risk, Red is bad, from the graph bellow only one red

Conclusion

With SCHD, you have A growth ETF so your capital growth over time that has a nice dividends so you get that passive income every month and when the pool of money is large enough you would be able to live off from it’s dividend without your capital being depleted. And financially, it was able to withstand the Covid 19 pandemic so far, it was financially negative affected but not like other ETFs