Why buy dividends paying stocks? Isn’t it better than non-dividend paying stocks?

The answer would be base on your financial status, location, tax brackets and others. Whether you are wealthy, rich or poor. Let’s look at it from a perspective point of view. Everyone view the world through the own experience. Everyone situation is different and could be quite unique.

Wealthy people tend to look at money differently than rich or poor people.

Wealthy people tend to manage their money differently than rich or poor people.

Wealthy people tend to spend their money differently than rich or poor people.

Wealthy people tend to invest their money differently than rich or poor people.

Wealthy people tend to handle their money differently than rich or poor people.

Unwanted tax events

Whey you get paid dividends usually you need to file a 1099 Int. or 1099 div. Which can lead to unwanted tax events.

Every year your income tax bracket may change.

There is a limit to the qualify dividend amount. After certain amount all dividends becomes non-qualify dividends which trigger a taxable event.

Many wealthy people don’t like dividends!

Many wealthy people don’t like dividends. Since, they make so much money, they are going to be on the highest tax rate bracket.

Because there is a limit to the qualify dividend amount. Once they reach that limit then they are going to be force to pay taxes on the non-qualify dividends.

On the other hand.

They can get capital appreciation through non-dividend stocks. Which means that their stocks increase in value as time passes.

Capital gains are not realize till they sell the stocks.

So, if they never sell the stocks then they never has to pay taxes on it.

Wealthy people get wealthier!

have you ever hear a quote that says “the rich get richer and the poor get poorer?”

Well, wealthy people get wealthier And this is one of the reason how.

If imagine someone have $5,000,000 in assets. Could be stocks or almost any other assets.

Actually to make it simpler, imagine that someone has 5 millions dollars on the stock markets. Every years the stock market goes up anywhere from 4-10% percent depending on the type of investment.

In the low end 4% of 5 millions is $200,000. So the wealthy person just gain $200,000 in capital appreciation. The wealthy person has not sold anything so there is no taxable event. So there is no taxes to pay.

The wealthy use their assets to fund their lifestyle

If the wealthy person need to spend money, they use some of the money that their assets generate to pay for their lifestyle.

Same example above. If the wealthy person made $200,000 in capital appreciation.

Now they have they 5 millions plus $200,000 which is 5,200,000 in just one year.

Pay attention!

During the year that the wealthy person accumulated that money, they had to spend money on the lifestyle.

Instead of selling the stock, the wealthy person can go to the stock broker and take a loan at 1-2%.

Just do the match. If you making around 10% and the loan is 2%, that’s a 8% difference.

This could work with any assets that you can take loan against it.

What if you are not wealthy?

If you are not wealthy yet, dividends may works for you.

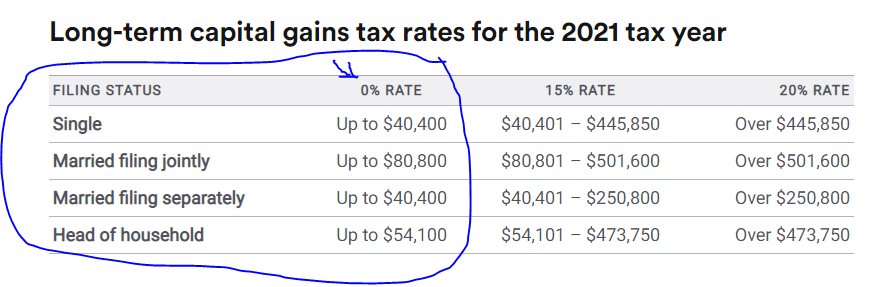

In 2021, if you are single and earn up to $40,400 in qualify dividends ONLY and there is no other type of income then you pay 0 taxes.

If you can you live off $40k at year, then qualify dividend investments maybe a great deal for you.

how much do you need invested in qualify dividends in order to get that amount?

40,400×25 = 1,010,000, so just about 1 million dollars.

That’s a lot of money. If you not lucky enough to have wealthy parents, then start from scratch. We all have to start somewhere.

The interesting thing is that we don’t know how long we going to to live. What if you get to live to 120 years.

Understand the tax system

If you want to be wealthy, you make want to start understanding the tax system.

That’s it.

Take a calculated risk.

Now, start and adjust as you go.