Develop These Good Habits to Build Wealth

Develop These Good Habits to Build Wealth. What if I told you that there is a secret to building wealth? It’s not about winning the lottery or inheriting a fortune. It’s about developing good financial habits.

Develop These Good Habits to Build Wealth

That’s right. By following a few simple rules, you can put yourself on the path to financial security and freedom.

Of course, there is no one-size-fits-all answer to building wealth. The best approach will vary depending on your individual circumstances and goals. However, there are some general good habits that everyone can benefit from.

In this blog post, we will discuss five essential habits for building wealth. These habits are simple to understand, but they can be challenging to implement. However, if you stick with it, you will be well on your way to achieving your financial goals.

Spend less than you earn

This may seem like a no-brainer, but it’s one of the most important things you can do to build wealth. If you spend more money than you earn, you will eventually go into debt. And debt is one of the biggest obstacles to building wealth.

There are a few different ways to reduce your spending. You can start by tracking your expenses to see where your money is going. Once you have a good understanding of your spending habits, you can start to make cuts.

Here are a few tips for reducing your spending:

- Cook more meals at home instead of eating out.

- Cancel unused subscriptions and memberships.

- Shop around for the best deals on insurance and other services.

- Buy used clothes and furniture instead of new.

- Take advantage of free activities in your community.

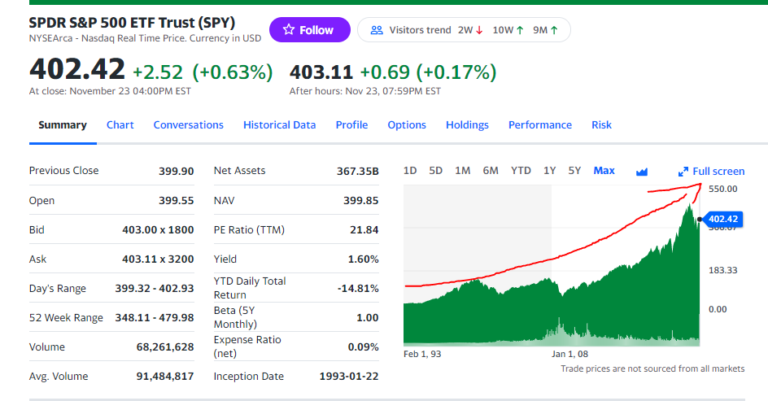

Invest regularly

Once you have reduced your spending, you can start to invest your savings. Investing is one of the best ways to grow your money over time.

There are many different investment options available, so it’s important to do your research and choose investments that are right for you. If you’re not sure where to start, you may want to consider working with a financial advisor.

Here are a few tips for investing regularly:

- Set up a recurring investment plan so that money is automatically transferred from your checking account to your investment account each month.

- Start small if you can’t afford to invest a lot of money at once. Even a small investment each month can add up over time.

- Reinvest your earnings to grow your wealth even faster.

Live below your means

One of the best ways to build wealth is to live below your means. This means spending less money than you earn and saving the rest.

Living below your means may seem like a sacrifice, but it’s worth it in the long run. When you live below your means, you’re able to save more money, pay off debt faster, and invest more for the future.

Here are a few tips for living below your means:

- Set a budget and track your spending to make sure you’re sticking to it.

- Avoid impulse purchases.

- Wait for sales before buying big-ticket items.

- Negotiate prices for services and products.

- Downsize your lifestyle if necessary.

Avoid debt

Debt is one of the biggest obstacles to building wealth. When you have debt, you’re paying interest on the money you borrowed. This means that you’re essentially giving away your money.

The best way to build wealth is to avoid debt altogether. If you do have debt, make a plan to pay it off as quickly as possible.

Here are a few tips for avoiding debt:

- Use cash or debit cards instead of credit cards.

- Avoid payday loans and other high-interest debt.

- Make more than the minimum payment on your credit cards each month.

- Consolidate your debt into a lower-interest loan.

Set financial goals

It’s important to have financial goals in mind when you’re trying to build wealth. This will help you stay motivated and on track.

Your financial goals may include things like saving for retirement, buying a house, or starting your own business.

Once you have set your financial goals, create a plan to achieve them. This may involve making changes to your budget, increasing your income, or investing your savings.

Conclusion

Building wealth takes time and effort, but it’s definitely possible. By following the five good habits outlined in this blog post, you can put yourself on the path to financial security and freedom.

Remember, the most important thing is to get started. Even if you can only save a small amount of money each month, it will add up over time. So start today and watch your wealth grow!

You May Like: The Power of Concentration: How to Focus and Achieve Your Goals

If you enjoyed this blog post, please share it.