How to get rich? I mean financially rich

Getting financially rich is hard but simple. There are many ways and strategies that people had use to get rich. I think that this is one of the best.

There are four main steps that you ought to do if you want to get rich. This is just my opinion, this is not legal advice, you should do your own research.

You ought to start spending a lot less than what you are earning

You ought to start controlling your expenditure.

Most likely at this point in time, you currently have a 9-5 job. When you get your paycheck, after all your expenditure, you ought to have a profit. You ought to have money left.

You can do this buy substracting your living expenses. like rent, utility, food, transportation, etc.

You ought to be super frugal at this point in time.

You are in a financially slavery situation, you don’t have the luxury to be spending money.

Therefore, do what you have to do, so you have some money left from your paycheck.

You ought to continuously find ways to increase your current income.

Finding ways to increase your current income should help you expedite the process of getting rich.

This is the part that many people don’t want to hear.

If you have a 9-5 job, you ought to find a second or third job.

If you have a 9-5 job, you ought to find a side business or multiple side businesses that generate income.

If this is not clear enough, let me put it this way. You ought to work on Saturdays and Sundays too.

Before you start coming out with excuses of why you are not going to have enough time and that you need a day or two to rest.

Well, let me tell you that you are a slave.

You have not enough money to live from your asset yet. Someone else currently dictate what you can buy, where you can go. Even a thing as basic as when you can use the restroom.

Basically someone else dictate what you can do and can not do. Simply because you don’t have enough asset to live from the interest that the assets generate.

Of course, you should sleep as much time as your body need so it can be well rested. Whether it’s 8 hours or more or less. But with the rest of the time, you ought to spend it trying to be financially free.

The world is not fair. The world doesn’t owe you anything. The world will eat you, chew you and spit you out like a used gum.

The reality is that you parents might have screw you up by bringing you to this world without an advantage.

Or you might had made really bad choices.

Whatever the reason, now you are here and you are an adult.

Take control and responsibility for everything that you do. Stop any victim mentality. If you don’t choose, someone else will choose for you.

You can keep living a life of wage slavery, a life of indentured servant or you can now start moving toward financial freedom. It’ s your journey, it’s your choice.

You ought to invest the difference between the money your earn and the money you spend wisely

Profit is income minus expenses. With the profits that you have left, you ought take that profit and you ought to start buying assets that are going to generate you more income.

By buying assets and reducing liabilities this should increase your financial wealth even more.

You ought to let it compound over time.

You ought to let compound over time. Meaning, you can invest in the long run. You ought to have long term investment portfolio.

Example:

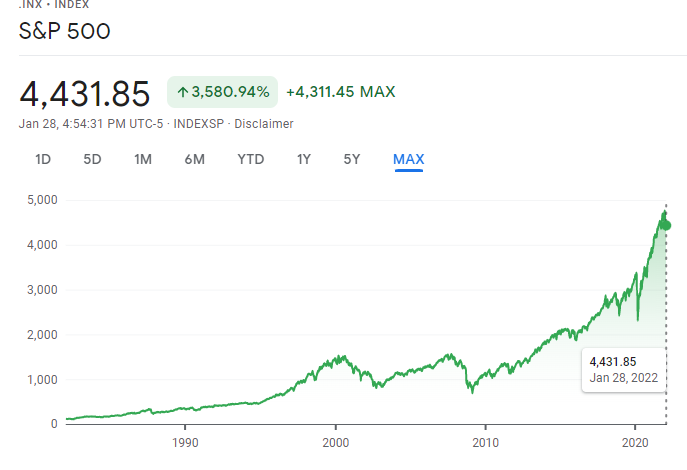

The stock mark is always going up and down. However, in the long run the stock market has always gone up. Therefore, if you were to invest money in an index fund and don’t sell, just buy and hold. the price that you buy stock will ended up higher.

Base on the graph the performance started near 0, now the performance is around 4,431.85

Of course, nothing is guarantee, but base on the graph performances even though stock market goes and down, in the long rung the stock market has shown to always gone up.

Once riches is achieved, you ought to allow a portion of the income that you assets generate to pay for your lifestyle.

If you keep buying assets and minimizing liabilities eventually your asset will generate enough income to allow you to work because you want to not because have to.

Example

If you were to accumulate 1 million dollars. And let’s say that you have a rate of return of 5% per year. so, 1,000,000x.05 = 50,000

In the U.S currently, the median yearly income is around $32,000. This mean that if you decide not to work anymore, you can live off that $32,000 and have $18,000 left to invest to keep growing your assets.

A thing to notice, I used median yearly income and not average yearly income.

Average is not a reliable way to measure because out of two people, one person can be earning 80,000 per years and another person can be earning 20,000 per year. If you were to calculate the average within the 2 people, the average will be 50,000.

Average just add total amount then divided by total number of people. 99% of the people could be earning low amount of money and if just one person earn a lot of money this could give you an unrealistic amount.

This process can be really slow however, you can get rich faster by increasing your income

The journey to financial freedom is really slow, so slow that many people give up. One way to expedite the process is to always keep finding ways to increase your income.

That’s why I think that instead of having a 9-5 job, is better to has two part time jobs. If you were to have a lost of one income then at least you have the other. Also, it would be easier to look for another job.

And if you are going to have another extra job, it better to be part time.

Doesn’t matter if you have 1 – 6 part time jobs. That’s just my option of course.

That’s it.

Take a calculated risk.

Now, start and adjust as you go.