Never lose money in the stock market – is it possible?

Never lose money in the stock market – is it possible?: Is it possible to never lose money in the stock market? The answer is probably yes. If this is possible , can the process be expedite? This two things is what this post is about…

Is it possible to never lose money in the stock market?

This is just my opinion, this is not financial advice.

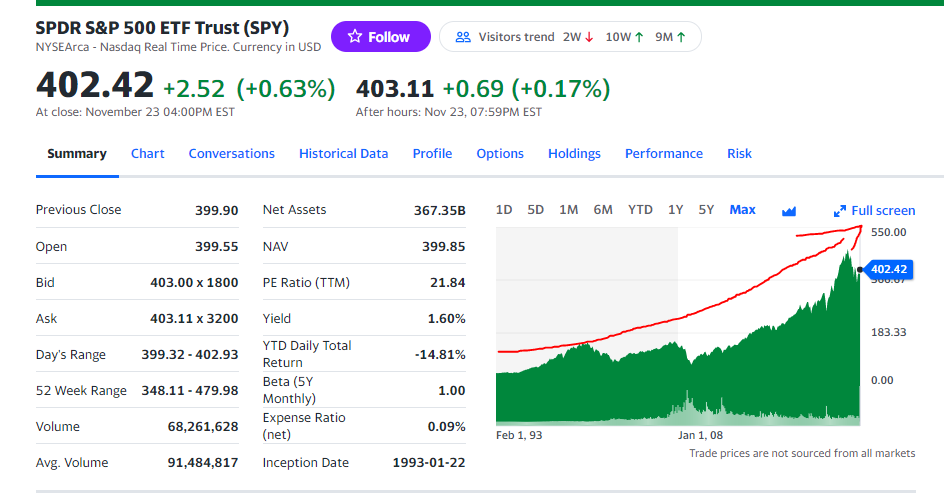

If you buy a index, eft or mutual fund, something like the S&P 500 so that you are well diversify, if you buy and never sell, just hold forever then you can’t lose money.

Unrealized gain and unrealized loss

There is something call unrealized gain and unrealized loss. When you buy shares of SPY for example, The price will go and down

When it goes up, as long as you don’t sell , it’s call unrealized gain because in reality you have not make any money yet.

When it goes down, as long as you don’t sell, it’s call unrealize loss because in reality you have not lose any money yet.

The price’s will always goes up and down, there is no taxes to pay because you have not sell yet.

Be profitable

Now if you want to be profitable you ought to only sell when it high and buy when it’s low, you pay your due taxes and keep going on. But this is for another topic, Let’s see how you can expedite the process

Expedite the process to never lose money in the stock market

are there people out there that never lose money whether the stock goes up and down?

Let’s assume that the stock is in bull market meaning that the stock goes up

- you can buy a stock,

- buy call option

- sell a put option

Let’s assume that the stock is in bear market meaning that the stock goes down

- you can short sell a stock,

- sell a call option

- buy a put option

so you might wants to look into

- Index funds – can only be trade at the set price point a the end of the trading day

- ETFs – can be traded during the day

- Margin ( optional) – borrow money from broker, leverage money

- Trading option – the right but not the obligation to buy or sell an asset a specific price on or before certain date

The strategy

- Buy shares of spy so now you own the shares

- then sell covered call, to get profit , assuming the market is going down

- then buy to closed the covered call, then buy to open first call on spy.

- then if next day look like you are in profit then deleverage, take the profit and repeat

Alternative you can try to find an eft that do this for you and just pay the etf fee.

What if next day is look like you are not in profit, then set up another contract to recover your lose.

===============================================================================>> oh dam never mind, ignore this post, this look like the martingale strategy in the stock market. Here I thought i found a way to game the system. <=======================================================