Scalping rules to be profitable

Scalping can be quite profitable when done right. It can also be really tough if you are a beginner. Let’s go over some useful rules

A few things to keep in mind first.

Day trading is for income producing activities. Just like you have a day job to get income. I look at day trading like a day job. You show up and do you work every day.

Some people like to day trade the whole day, other people people like to day trade for less than 2 hours per day. There are people that just to day trade for just a few minutes when the market open.

Swing trading is for residual wealth creation. You set up a specific trade and it could take any where from 1 day to 90 days or more as long as it is less than a year before you touch that specific trade gain.

Long term trading is for passive wealth creation and generational wealth. You buy and hold until you died or until you make a profit. A specific trade could take any where from one year or more before you touch that trade again.

There is a humongous tax benefits for holding for over a year.

Scalping in trading is when a trader profit off a really small price change. The scalping strategy is simply, opening and closing a trade in a very short amount of time with the intent of making a profit.

Ok now that we got that out of the way, let’s us continue with the scalping rules.

We become proficient at what we repeatedly do

Just practice trading everyday. The more you do it, the more proficient you become at it.

It’s like walking. We did not born knowing how to walk. We saw someone else walking, we try to do the same thing until we eventually walk, then walked so many time that now, you just walk without thinking.

This apply to any skill that can be learn by repetition.

You might have notice that I said just practice trading everyday. It does not have to be just day trading or swing trading or long term trading. It ought to be a mixture of them.

Persist and Do not ever give up

It could be frustrating for some people to not see big results right away. The feeling of giving up may show up but as long as you persist and never give up eventually you will become profitable.

Question

How long will it take to be a profitable trader?

Answer

As long as it take.

You could be so f… dumb that it could take you years. Some people are stubborn, some people like to do things completely alone, some people do not want help from others.

In general, you might either are going to break even or lose money in your very first year. And as long as your stay persistent and don’t give up, eventually you’ll figure it out on your own.

One of The best thing that someone can do is get a mentor, someone you can trust. That person being there and done that. That person already have what you want.

Getting a mentor will save you time, money and although not all but many of the miseries of trials and errors.

Or

You could be so smart that it just take you weeks or months.

Or

You could be one of the luckiest person on earth and you just happen to start trading at the right time with the right conditions and just got lucky and the rest is history.

My point is that I don’t have a crystal ball to see the future, I don’t know what kind of self-sabotage habit you have.

What I do know is that we become proficient at what we repeatedly do. You can verified this yourself with your own history. Just look at something that you really good at or at something that you really bad at.

Yes, the same way that you can train yourself to do something good in the right way, you can also train your self to do something bad in the wrong way.

Habit does not care about good or bad. This bring us to the next topic

Right from the start, trade with a good strategy

You ought to start trading right from the start with a good strategy. If you trade long enough, eventually this will become a habit.

Once something becomes a habit, it’s extremely hard to get rid of it.

Therefore, you should start right from the very beginning doing things the right way so you can develop beneficial habits and not harmful habits.

Start with a small amount

I know most people want the big money $$$ right away. We doing this because we want 100s, 1000s of dollars on a consistent basic.

But let’s be smart and reasonable. Let’s start the right way.

First

Learn to make a $1 dollar and most importantly learn to keep that $1 dollar.

Rinse and repeat until you get it down to a science.

basically, You ought to become so comfortable and consistent making and keeping that $1 dollar or $5 dollars or $10 dollars or whatever small amount amount you chosen.

That it has become second nature to you. It has become kind of a habit. You just kind of instinctively know what to do when trading.

Second

Now that you have mastered how to be profitable with small amount. You then increase the amount a little more. Maybe $20 dollars, or 50$ dollars or $100 dollars whatever you feel comfortable with.

Rinse and repeat.

Why do it this way?

The reason is because human emotions get in the way.

You can have the best strategy in the world. Super easy to follow.

Imagine you were to trade Just 1% of $100 dollars, if something were to go wrong, that’s just $1 dollar lose, no big deal.

But let’s do some simple math to see if you can keep your emotion in check.

- 1% of $100 = $1

- 1% of $1000 = $10

- 1% of $10,000 = $100

- 1% of $100,000 = $1000

- 1% of $1,000,000 = $10,000

You see, losing $1 dollar in a trade is no big deal, but losing $10,000 in a trade could cause all kind of emotions.

Losing big trades make rational thinking go out of the window.

That’s why you learn to be profitable with really small amount first. You learn to make it and to keep it. With small amount of money, there is no problem following the scalping trading strategy. Since there is very little or no emotion involve.

so, make it a habit.

Because as the amount your are trading goes higher, the more difficult is to keep emotions out of it. If you don’t create the right habit, Well, you are going to get hurt.

When thing get stressful, most likely you are to forget the strategy that you are suppose to follow and do something else , something odd and stupid.

Therefore, There should be no emotion in trading. You pick a scalping strategy and follow it. Once you gain mastery, you then increase the amount of money just enough not to feel any kind of stress.

In trading, you can be wining 70% or 80% percent of the time. But these 20% to 30% losing trade is something that you ought to get used to because there are going to happens. That’s part of trading.

Do not break the scalping rules

I already explained it previously, Just in case you missed it. Do not break the scalping rules.

Whether because of emotion or because you got lucky in a few trades or because you got a really bad trade, People tend to deviate from the goal.

Follow the rules you have set. There are there for a reason.

Track all of your results

This is something that many people don’t care but is it’s important.

You want to be able to look at the data. Review the data, keep what’s working and improve what’s not working.

Become knowledgeable on the market structure

What do I mean by market structure?

To keep it short and simple and not confusing, basically what the price movement is doing.

You ought to know when the market is trending, like when it’s trending up or trending down depending on the time frame of the chart.

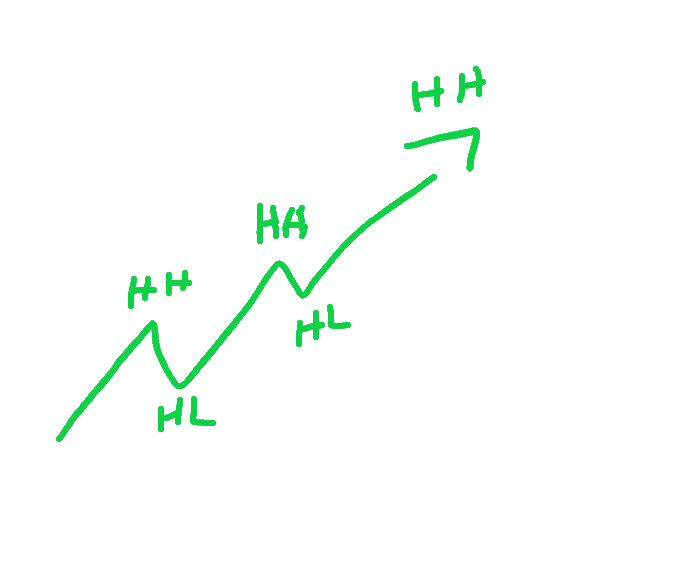

Bull trend is up, like higher highs and higher lows. The trend is consider reverse when a Lower low show up.

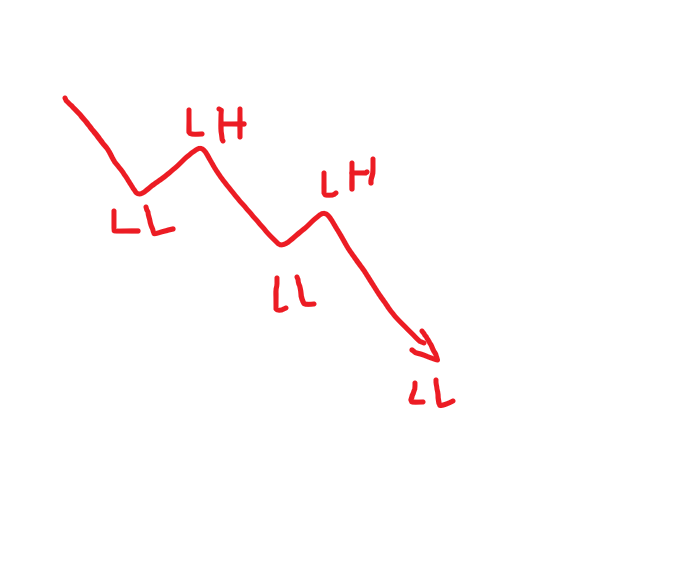

Bear trend is down, like lower lows and lower highs. The trend is consider reverse when a higher high show up.

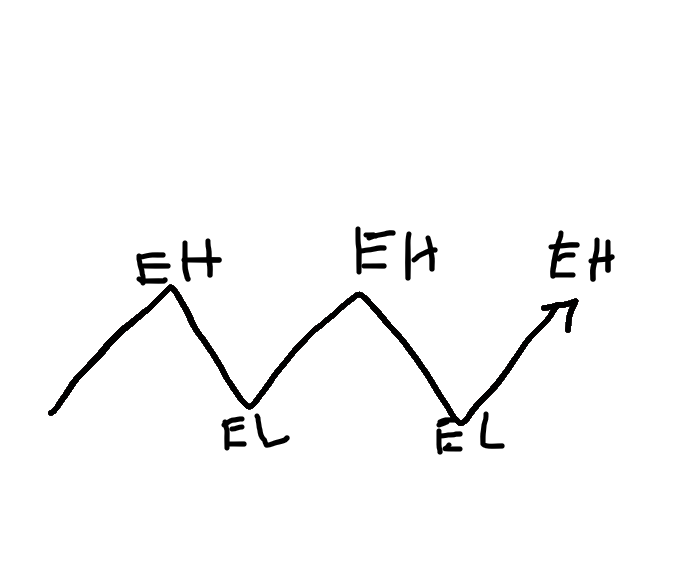

You ought to know when the market is ranging, like when it’s going sideway.

Sideway is about equal highs and equal lows. The sideway trends breaks out from the top of the range or the bottom of the range. Break out meaning that it will change from range trend to up trend or down trend.

Therefore, You ought to know about the signs that the price maybe reversing from trending up or trending down, about the signs that the price maybe breaking out from trending sideway.

What else? dam my thoughts are going blank. ah, overtrading.

During trading, Do not overtrade

What do I mean by do not overtrade?

Some people like to trade the whole day. But I don’t.

I think is better to just trade once per day, Maybe twice. Just in and out. Go in make some profits and get out.

Two reasons come to mind.

One

There is a reason that the human body need resting every day. like the sun goes up and the sun goes down.

You go in well rested, You are ultra focus, make a profit and get out.

Your will power will deplete though out the day. Your focus will not be the same during the day. The more trade you make during a specific day, the more tired you get. The more tired you get the less efficient you are.

So, you are most likely to make mistake when tired.

Two

Emotions get the best of us.

Have you ever being playing a video game or competing against someone in anything and you suddenly lose.

And your reaction is I want pay back, I want revenge, I want to win!

Well, once emotion is involve , it’s a fools game. Since you not longer trading from an advantage point.

The in and out is for day trading, if you are swing trading or long term trading then is ok if you want to spend more time during the day looking up trades since is more layback and long term trading.

Final thoughts

If you can take just one thing from this post is that We become proficient at what we repeatedly do. Whether is good or bad, Repeat it long enough and it will become a habit.

Since once something becomes a habit is extremely hard to get rid of it. If you are going to be stuck with a habit, might as well be a beneficial habit.

Ok, that’s it for today.

Take a calculated risk.

Now, start and adjust as you go.