The Secrets To Becoming Wealthy that they do not want you to know

The Secrets To Becoming Wealthy that the wealthy do not want you to know…

The Secrets To Becoming Wealthy that the wealthy do not want you to know

Spend less than what your earn and invest the rest.

It’s that simple.

Example

If you earn one $100 , you ought to spend less, maybe $70 and and invest remaining $30, it could be more or less that’s up to you.

But what most people do is they spend the whole $100

or even worse

If they have a credit card that most people do nowadays, then they spend the $100 that they earned and also the credit card amount of $100 if that’s their credit limit, so now they are into more debt.

Spending the money on the credit card is good for the person that is lending you the money but is not good for you since you are not making any money.

Example

Another example is you also have people that save a portion of the $100, maybe like 10% to 20% which is great but they do not invest it. so as time past by the yearly inflation diminish the buying power of the money that they saved.

Example

Another example is people buy a car when they can not afford it, the car is a depreciating in value as time passes.

Example

Another example is you have people that buy a house that they cannot afford, if that house it’s not bringing you income, then it’s a liability.

People want to be told what to do

A lot people wants other people to tell them what to do, how to invest but that’s not a good approach because you need to learn the skill even if someone else is going to be managing your money. So you need to learn how to manger your money and how to invest.

Managing your money with a portfolio and investing for income.

by the way, this is not financial advices, this is just my opinion

Example

Instead of investing in individual stock, invest in EFTs instead.

If you invest $100 in an individual stock and that stock goes bankrupt then you lose 100% of the money.

But if you invest $100 into an ETF, an ETF is a collection many stocks. Then if one of the company goes bankrupt, if the ETF have 100 individual stock at 1% each, then you just lose 1%. hypothetically speaking, so you still have 99% of the money left. then the broker that is managing the eft, just remove that one individual stock from the ETF and they just add another, and your portfolios not affect that much

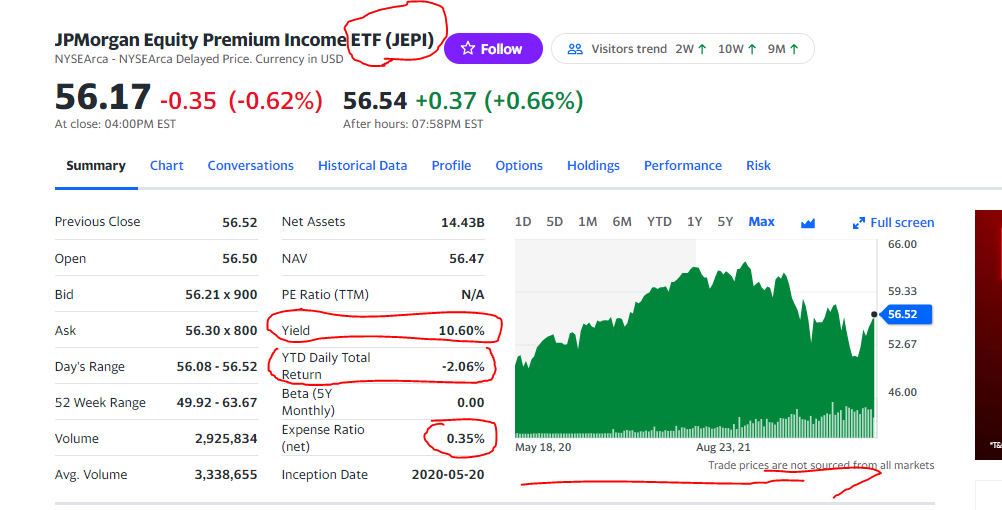

JEPI

Look at this ETF called JEPI 10.60% dividend Yield, if you invest $10,000 you get $1060, look at that graph, green, look at the YTD Daily total return -2.06, this thing can fight the pandemic

The 4% rule

There is something call the 4% rule that state that you can withdraw 4% of your total investment during retirement and it should last you until you died.

The problem with the 4% rule is that it deplete your capital.

I think your capital should always be protected , so when you journey end, it can be transfer to your next generation.

People like to invest in grow stock then during retire change to dividend investing

I rather invest from the start in dividend investing

I love to see that cashflow, so I don’t have to never touch the capital, also, since you are getting cashflow, you can sometime use that money for something else or you can reinvest

look at JEPI, around 10% apy, so if you portfolio is $200,000

the you get $20,000 pear year or 1666 per month, that’s before tax , some eft have qualify dividend where you pay 0 taxes.

Property cashflow and REITs

Some people like to invest into property to get cashflow,

its a lot of work if you do it yourself or you can get a property manager, and not just anyone it has to be the right property manager. You allow the manager to take care of the property for a fee,

I rather invest into REITs , it’s kind of similar but in the stock market. When your own properties you have to deal with a lot of people, but with REITs you don’t have to to deal with the property and tenants, you don’t have to deal with the property manager, you just needs to manager your stock portfolio which include REITs if you invest in them

So spend less than what you earn and invest the rest.

So you ought to focus on buying income producing asset and avoid liabilities.

If you want to increase your income you can start a side hustle or a side business or you can buy a business that is already generating income.

But regardless of the profit from the business you still needs to invest and learn to manage your portfolio.

Investing is a skill that must be learn. Investing can be really passive once you do your research and find in what to invest.