The simple path to wealth with dividend investing with Dividend Growth Investing, my reaction on it

The simple path to wealth with dividend investing with Dividend Growth Investing, my reaction on it

You can either watch the video or you can read the highlights below the video follow by my reaction on it.

Highlights

If your goal is to rich FIRE (Financial Independence, Retire Early) and you wants to focus on the 4% rule then you buy Vanguard Total Stock Market Index Fund (VTI), it holds growth stocks , value stocks, unprofitable stocks, profitable stocks everything summed into one index.

If you want to be a dividend investor, his suggestion is to take a similar approach to The simple path to wealth, with the 4% rule too but instead buy SCHD and DGRO as often as you can and hold them forever, the difference here is that you don’t have to liquidate your shares to get income, you’ll live off the dividend income from these two ETFs, you can buy 50% SCHD and 50% DGRO of these to ETFs.

SCHD and DGRO have low fees.

SCHD and DGRO are tax efficient, there is no REITs.

Aim for dividend yield and dividend growth rate and dividend safety ETC.

DGRO is focus on dividend growth.

By combining both SCHD and DGRO, you get more exposure to the overall market.

By combining both SCHD and DGRO, you are getting low fees.

They are tax efficiency since they are excluding REITs.

The smoother path to wealth

In the traditional fire movement you invest 100% into VTSAX or VTI then once you get closer to retirement then you add a percentage to bonds.

So you have

the wealth building portfolio (100 VTSAX and 0 to 5% cash held in VMMXX for upcoming expenses.

you have

the wealth preservation and building portfolio 75% VTSAX for growth, 25% VBTLX bonds for deflation hedge and 0 to 5% VMMXX.

Suggestion,

HIs suggestion is instead of bonds, consider other options with higher yields that what you would get with SCHD or DGRO, a suggestion is to look at covered call ETFs like JEPI

The reason why you would add bonds to the portfolio is to smooth out the ride, the reason to add JEPI instead of bond is similar reason but since JEPI has higher yield you get more income.

JEPI is good for retirement or when getting close to retirement

His Conclusion

5 years time horizon or more , The simple path to wealth with dividend investing will look like 50% SCHD and 50% DGRO , set it and forget it.

Sooner than 5 years, you looking to live off your dividend portfolio then The simple path to wealth with dividend investing will look like 38% into SCHD, 37% in DGRO and 25% into JEPI

JEPI is tax as ordinary income so no tax efficient, and expense ration is higher but in return you get higher dividend income to be able to live off , but JEPI help you keep diversification because is base on the S&P 500

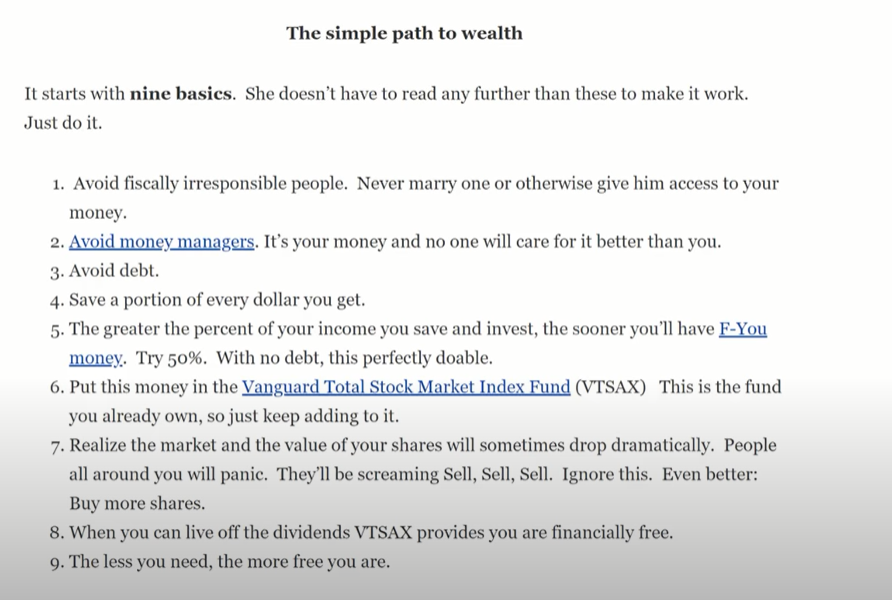

Oh by the way you can also start and follow the 9 basics instead and adjust as you go, here is a image of what he provided about it.

My conclusion and opinion on it

I rather go for high yield dividend income such as JEPI from the start even if you are young, even if in the end I am getting a little less money,

the reason why is that when you are getting that high yield dividend income every month, you can either use that dividends to pay bills or to reinvest it into your portfolio so you portfolio can grow bigger.

also when you see that dividend income every month, it does something to your brain, it’s like a video game, you get that dopamine hit, you feel like you growing stronger, you feel like you actually getting some where,

specially when the market clash, if you getting high dividend yield you don’t stress about it.

If you are interested in reading the amazing book ,you read The simple path to wealth by JL Collins