Dividend investing – two school of thoughts

One school of thought think that when a company pay dividends, the value of that company drops exactly as much as the dividend that was paid.

The other school of thoughts think that this is not true, that in actuality there is an excess revenue that the company is not able to reinvest.

So that excess revenue that the company was not able to reinvest is distributed to the share holders. In other words it’s pay as dividends.

The value of that company drops exactly as much as the dividend that was paid

Example :

Let’s us imagine that a company 1 share of stock is worth exactly $100. It has a 12% yield and it pays dividends monthly. The night before the dividend is paid the value of the stock drops $1, In the morning the stock is now value at $99 per per share.

You now have $1 paid as dividend and the stock is worth $99 per share.

If you keep the dollars then the money is coming from your capital since you initially invested $100.

You would need to reinvest the $1, in order for the share to be worth $100 again. But you now might have to pay taxes on that dollars if the dividends it not qualify. Non-qualify dividends are tax as ordinary income.

So it does not look like you coming up ahead if you do no reinvest the dividends

There is an excess revenue that the company is not able to reinvest

Same example, the difference is that when you get paid that $1 dollar, you get to keep that one dollar and does not have to reinvest, the stock value stay the same $100.

We have 4 outcomes

- The first is right and the second is wrong.

- The first is wrong and the second is right.

- Both the first and the second are right.

- Both the first and the second are wrong.

What I think is happing

Not all dividends are equal.

But in general dividends do not affect the stock price directly. Just because you get paid dividends it does not mean that the stock value is going to decrease or stay the same.

What is affected is how people feel about the stock. So people sentiment is what affect the value of the stock.

Example

If the company raise it’s dividend much higher than the market expect then price of the stock might go up because this is a positive new.

Same analogy, if the company decrease it’s dividend much lower than the market expect then the price of the stock might go down because this is negative news.

hence, in reality what affect the stock price are people’s sentiment.

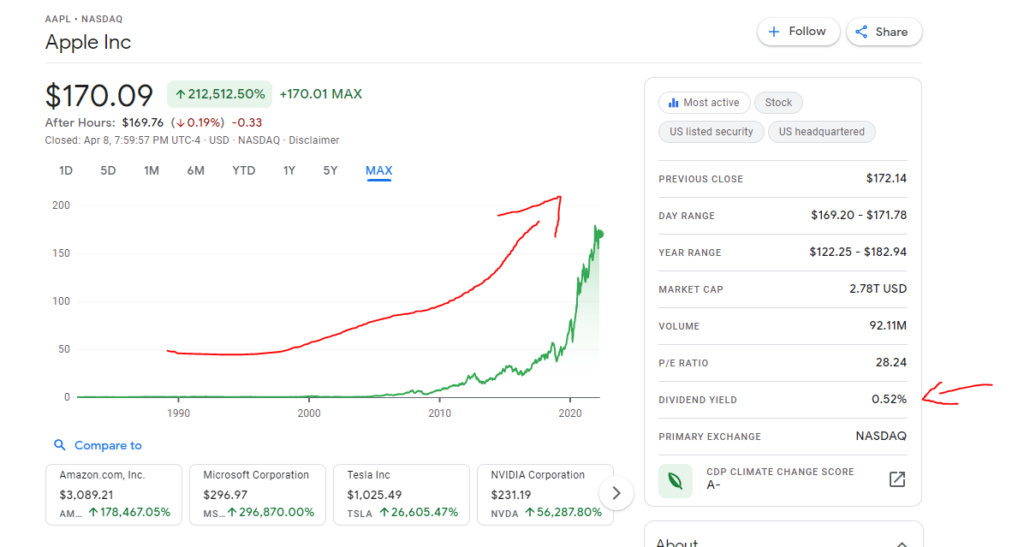

This is what I mean, Look at apple, the dividend sucks but they pay dividends, you can see there is a a up trend on the max tab, so in the long run the price has always increase.

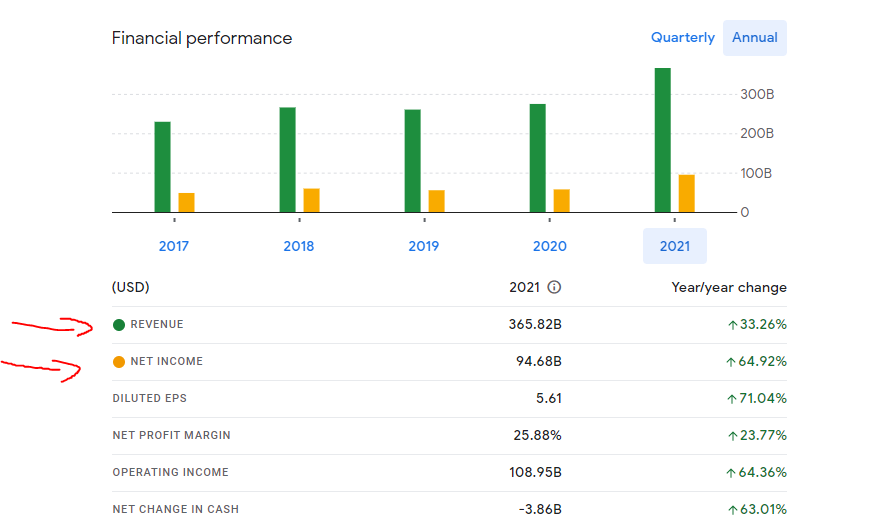

Now, lets look at yearly revenue color green and profit gold color. Both revenue and profits has increase even thought they are paying dividends.

Although it the end it does not really matter, What’s matter is, it’s your investment making you money or not.

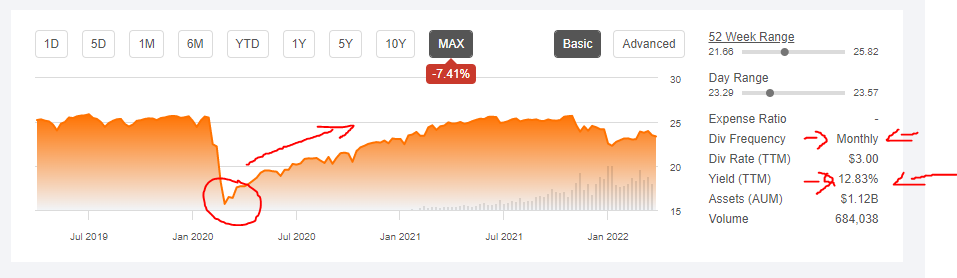

Look at RYLD, trend is not up or down, It’s sideway. And it has currently 12.83% yield and it pays monthly dividends. Whether or not you were one of the lucky bastards that invested when the stock price was at $16, now currently around $24.

If you being owning this covered call eft you should be making money. Again 12.83% yield and it pays monthly!

That’s it.