Dollar cost averaging – explained and simplified

When investing you can do day trading, swing trading and long term trading. Today, we are going to focus only on long term investing. You can invest by timing the market and by not timing the market. Not timing the market is call dollar cost averaging. we’ll go over what is it? Does it works and how can you do it.

What’s dollar cost averaging?

Dollar cost averaging is an investment strategy that aims to minimize risk by investing automatically and consistency. When you purchase equalities, aka financial assets. You can either buy it as lump sum or small sum.

The impact of Volatility aka risk , it’s maybe reduce by purchasing small sum of financial assets automatically and on a consistent basics.

The purchase interval could be daily, weekly, biweekly, monthly, quarterly, yearly or whatever tickles your fancy. The important thing is that must be automatically and consistency, so you have not to stress about it.

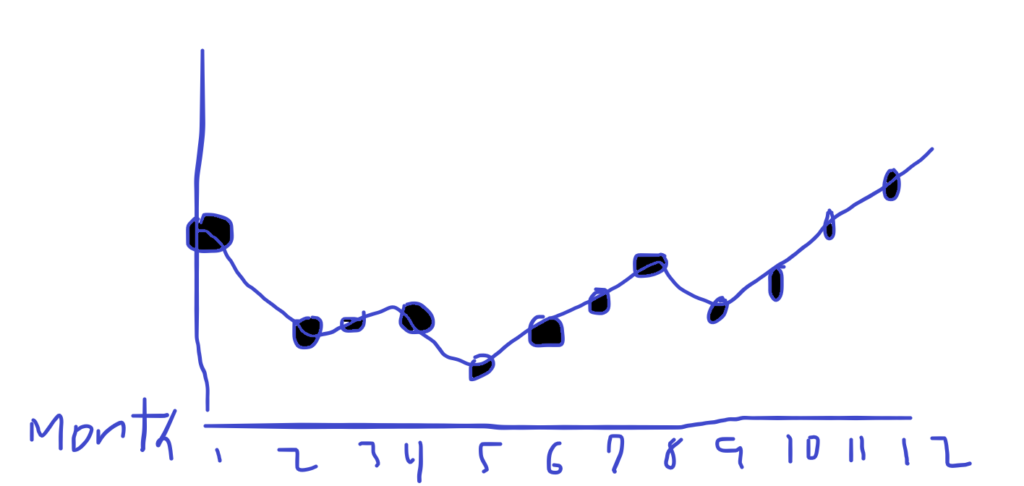

Let’s look at an example with the awesome drawing. Imagine that you are investing 1000 per month. automatically and consistent.

The black circle is the current price and each month your are investing your $1k.

When the price is low it mean that you can buy more shares. Have you ever hear the saying buy low and sell high. In this case you buy and hold.

When the price is high it mean that you can buy less shares.

Unfortunately, Most human are control by emotions. When they see the price goes up they buy and whey they see the price goes down they sell. When in reality it should be the opposite.

Now, if you are using the dollar cost averaging you can take advantage of when the price goes down and buy more share automatically.

Here is ah ha moment. Imagine if you had invested on Amazon when it was at low price. How about Facebook? google? I Hope you see the point.

Does the dollar cost averaging works?

Does the dollar cost averaging works? Yes it does over the long term. It works with long term investing for a simple reason. When you look at a chart price tend to go up and down. But in the long term asset prices tend to rise.

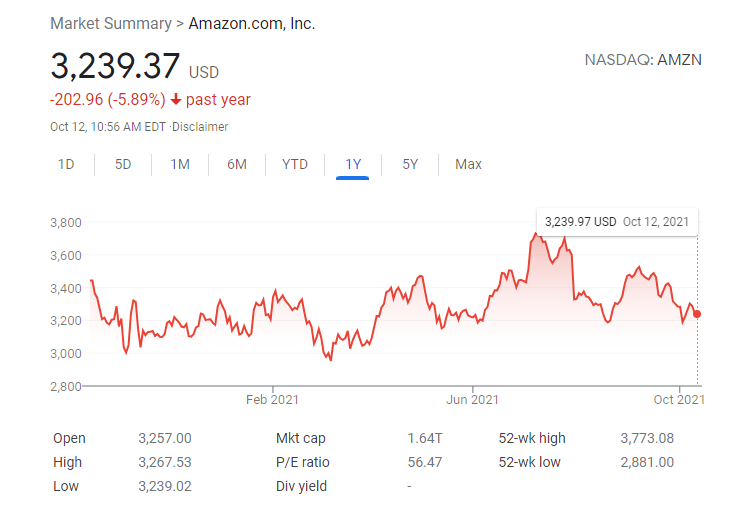

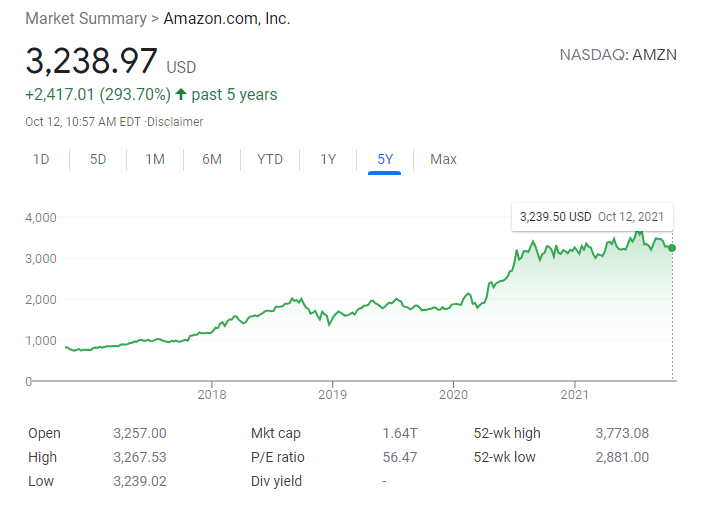

Look at amazon stock 1 year chart vs 5 years vs max years.

1 year chart

5 years chart

max years chart

Image if you have bought 1000 shares when amazon priced was $2. That’s $2000 dollars, even though we are talking about dollar cost averaging . Let’s image that you just bought that 1000 shares. Today does $2000 dollars would have turn into 3245.39×1000 = $3,245,390

This show that you don’t have to be Jeff Bezos. You just need to ride the train even on the roof if you have to.

Here is ah ha moment.

Have you hear all the talk about bitcoin and cryptocurrency? What if a portion of a portfolio is use to invest into the future. Since there are so many cryptocurrency. What if someone were to just buy a bunch of different ones when they are really cheap. I’ll just leave it at that. Do your research.

Anyway, I almost got sidetrack there, going back to dollar cost average. There are many reason why dollars cost average works.

here are some of the main reasons.

One is reason is anybody can do it. Whether you are poor, middle class or rich. Whether you are getting a paycheck or salary or cashflow. You can automatically and constancy invest every time you get that paycheck. Nowadays you can even invest $1, it’s call fractional shares.

Second, which we already kind of discussed. It reduces your stress level. Since it’s done automatically and consistency, you don’t have to time the market. Therefore, You are not emotionally involve in the ups and downs of the market. You just buy and hold.

third, I think, warren Buffett Said ” If you don’t find a way to make money while you sleep , you will work until you died” this bring us to your money is working 24/7. As soon as you get that paycheck, automatically and consistency a portion of that money should go to work for you.

And the money’s children’s children should work for you as well. That interest should compound and compound and I hope yo get my drift.

Four, it’s call dollar cost averaging for a reason. Just incase you forget or missed one of the points. As you buy more shares when the price is low. You reduced your average cost per share over time. That’s why in the long run is a great strategy.

Fifth, financial freedom, yeah! you know what, I am not going to go into it. Just know that the ultimate goal is financial freedom, peace of mind and physical health.

How can you do dollar cost averaging?

Fours ways you can do dollar cost averaging.

With Broker:

By getting brokerage account. Such as vanguard, fidelity, you may choose Roth IRA or not, You may choose index funds or not. You may choose eft or mutual funds or you may not, Just check the platforms. There are many options.

Robinhood supports automatic investment in ETF as well as fractional shares. But if you look at vanguard it does not support automatic investment with ETF but does support automatic investment with Mutual funds.

So Always do your research since things can change.

Without broker:

by by investing in direct stocks.

by opening an online brokerage account.

by investing in dividend reinvestment plan.

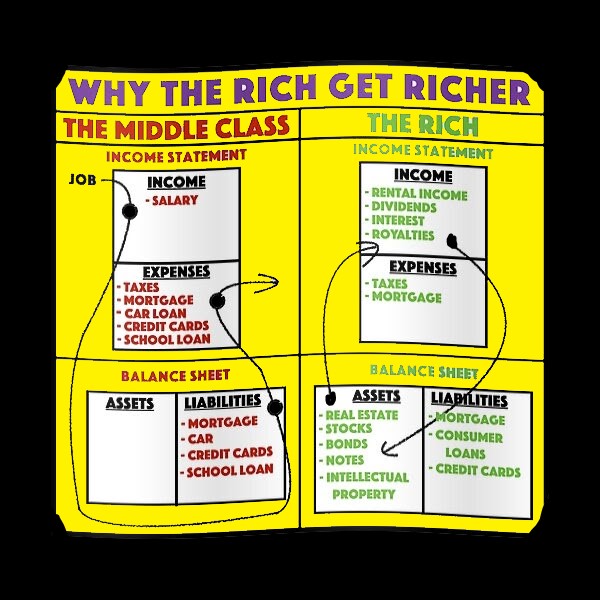

Final thoughts, ideally you should have a business financial statement or a personal financial statement. You may want to do some research on Robert Kiyosaki.

Look at the right side on the chart. Your assets generate cash flow and with the income or cashflow generated by your assets, you buy more assets.

Also you should take a small portion of that portfolio. I think Kevin O’Leary AKA Mr. wonderful suggest no more than 5% of your total asset into one asset. No more than 5% for risk management, you may want to look into asset classes as well.

Thanking for visiting, now start and adjust as you go.