Increase your income and invest the extra income into dividend paying assets

Increase your income and invest the extra income into dividend paying assets: I was consuming some information on how to become a millionaire. This person stated that in order to become a millionaire, you have to stop buying things you don’t need and stop buying things to impress others. Also, invest $1,000 to $3,000 in the stock market every month.

Increase your income and invest the extra income into dividend paying assets

By investing that money into the stock market, in the long rung, you eventually become an millionaire.

while I was consuming this infomation , I was thinking to myself, this person must be detach from reality, this person is living in a little bubble.

Why?

Because there is something called concept, this is something that you know is a general knowledge and does not have concreate body. It just exist in your thought. Then there is execution, this is when you actually take action.

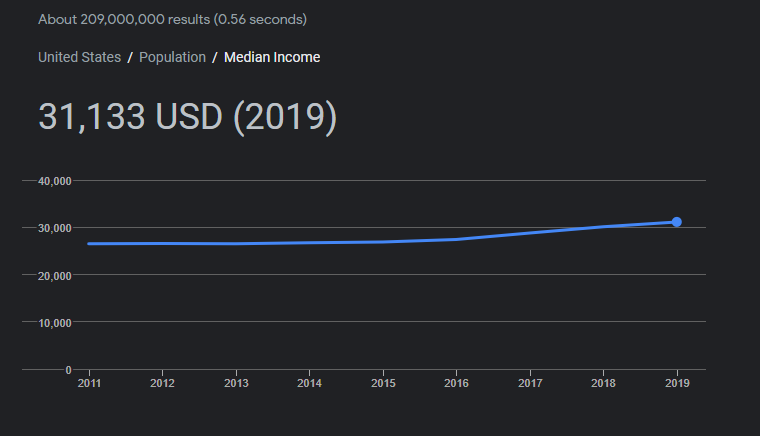

Now, this person is talking about you should invest $1,000 to $3,000 dollars into the stock market per month. But when you look at the data, the median income in the united states is about $31,000 dollars.

If you invest $1,000, that’s $12, 000 per years after tax.

If you invest $3,000, that’s $36,000 per years after tax. Which more than what the United State median income is.

Who is this person talking too?

Obvously not to the average person.

There is this wrong assuming that most people buy things they don’t need and buy things to impress others. Althoght there is some kind of true to this statement, this is a little be misleading.

The reality is that most people do not earn enough income. So if anyone wants to be rich, the first thing they ought to do is increase their income.

The reason for this, is that you can always minimized you expending to a certain point depending on your current income.

Example:

let’s assume that person A has a yearly take home pay of $25,000 and the expenses are $25,000 too, so at the end of the year you have $0 saved.

let’s assume that person B has a yearly take home pay of $100,000 and your expenses are $100,000 too, so at the end of the year you have $0 saved.

A option person B has is that person B can say, well let me relocate to an area where my yearly expenses are $25,000, as a result saving $75,000.

But Person A does not have the option to do the same, there is cap on the amount of living expenses that you can cut.

Moral of the story

The point of the story is that you are ought to focus on increasing your income. As you go through life, you learn to adjust and make better decisions.

You might want to read Assets protection is important for the little guy