Selling put options for passive income – Much better than buying stocks outright

Selling put options for passive income – Much better than buying stocks outright: This is one of the best trading strategies out there. You can make money whether the stock goes up, down or sideway. Some people call this strategy the “wheel strategy” although there are many variation to the wheel strategy.

The worse thing that could happen is that you get paid to own the stock you want to own anyway at a cheaper price. Which technically speaking, the worse that could happen is that you are buying low and selling high.

This strategy analogy is like you are the casino instead of the customer gambling. You might have heard the saying that said that the house always win.

Another analogy could be that you are the insurance company instead of the insured.

Stocks vs Options vs Futures

Now, before we start with the strategy, you need to know this:

You can trade stocks, you can trade options and you can trade futures.

We are going to be talking about trading options.

Some Terminologies

here are some terminologies so you can have a better understanding as we go through

Selling options:

Put

When you “sell a put” you are agreeing to purchase a specific stock at a specific price at a specific time.

Call

When you purchase a “call option” you buy the right, not the obligation to purchase a specific stock at a specific price at a specific time.

basically, you are hoping that the stock appreciate in value so you can sell the option for more money or you can exercise the right and purchase the shares at the strike price.

One contract is equal to one hundred shares of stock. ( 1 contract = 100 shares )

Selling put options

Step 1 – Sell put option and collect the premium

When you sell a put option, a money collateral worth of 100 share of stock is held. just in case you are force to purchase the stock. Also at the same time you collect the premium meaning you get paid money right away.

Step 2 – Two outcomes – you might or might not have to buy stock.

Outcome 1

If on expiration date the stock is trading above the strike price that you have chosen, then great your collateral is release and you can start over buy selling a put option again.

Since you now have you collateral back and you also have the premium from before.

Outcome 2

If on expiration date the stock is trading below the strike price that you have chosen then you might get assigned, meaning that you have to buy the 100 shares of stock. So, now you own 100 share of stocks.

You also keep the premium from before.

Hence, you got paid to own the stock you want to own anyway at a cheaper price!

Hence, remember the saying , buy low and sell high? Now since you own a value stock which eventually will go up ,hopefully of course. When that happens, you can now sell your stock at a high price.

Step 3 – Sell call option and collect the premium.

Which stock to buy

Growth stock : no, is better to avoid them

Value stock : yes

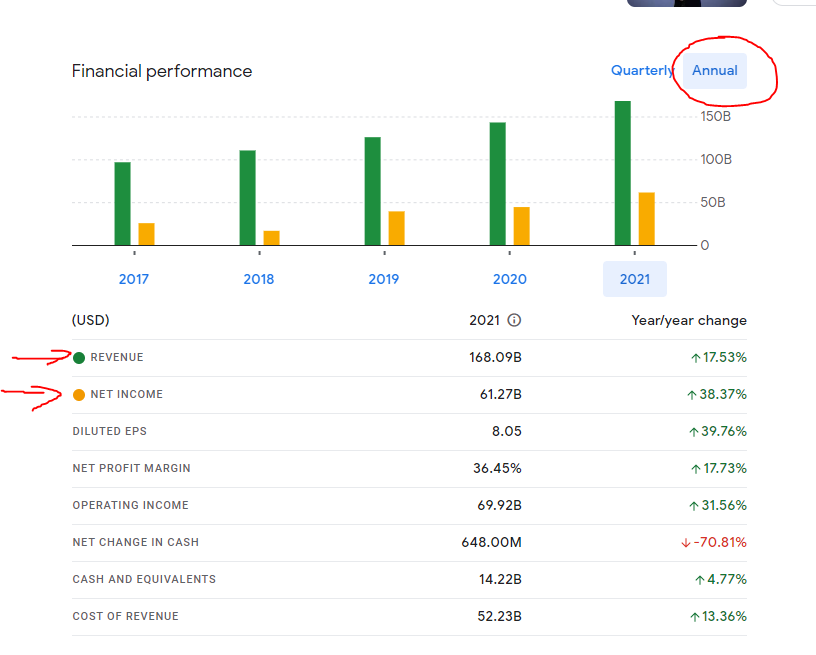

- They make money, meaning the company make profit (net income).

- They have moderate growth, meaning the trend is going up(revenue).

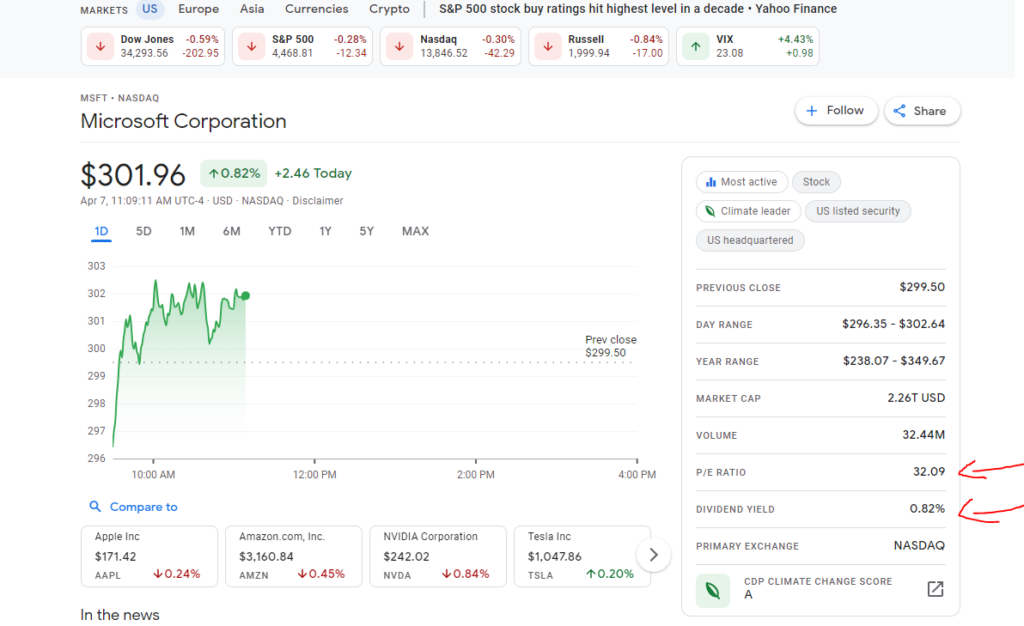

- P/E ratio is low, if there is none then it means that the company is not making money yet.

- They pay dividends, if there is none then it means that the company do not pay dividend.

You can make money whether the trend is going up, down or sideway.

But since you are only suppose to trade on stock that you want to own! I rather trade on up trend.

example :

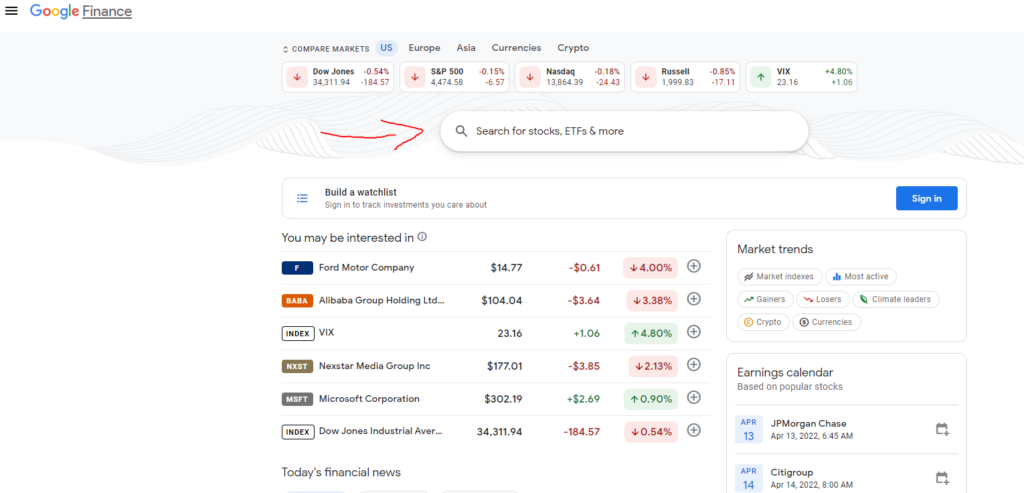

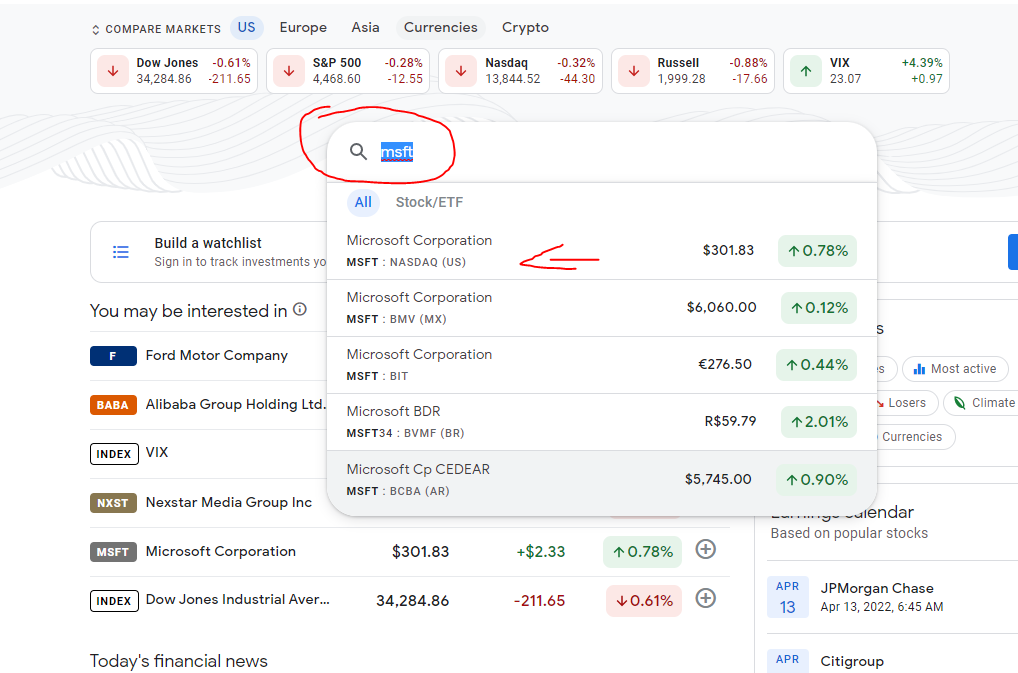

Go to finance.google.com or finance.yahoo.com , search for a stock any stock.

Type MSFT on the search for stocks bar and click on MSFT: NASDAQ (US)

This will bring you here where you can see the p/e ration and dividends

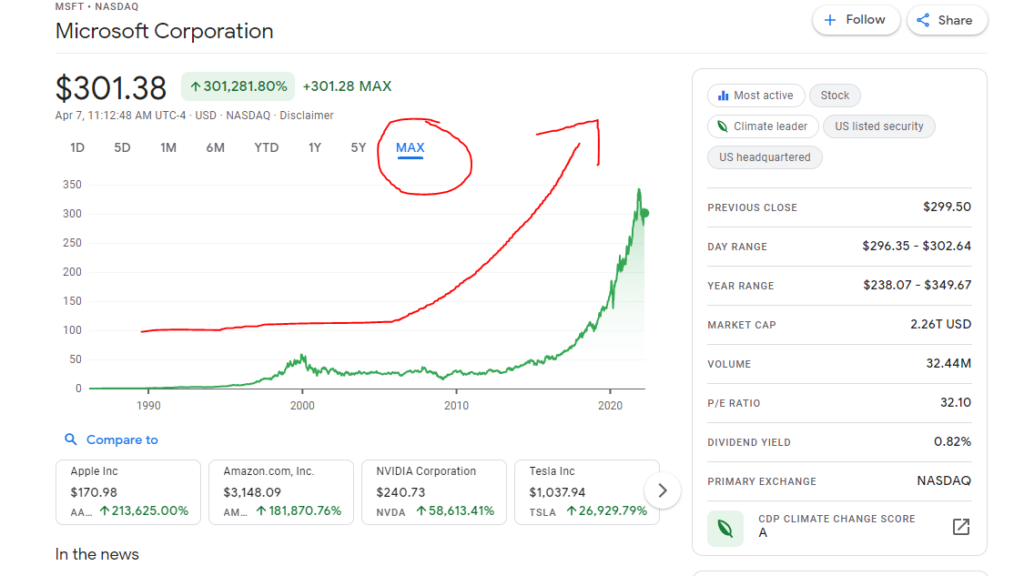

Click on the max tab and see the up trend, in the long run this stock have always gone up, so if in the worse situation you get stuck with the stock, you just hold until it goes up in price again. You can check the 1D, 5D, 1M, 6M, YTD, 1Y, 5Y and MAX graph . The stock goes and up down but in the long run it always gone up.

Now scroll down the page to financial performance and click on annual tab, there you can check the revenue and profit for each year.

What option to choose?

You can choose any expiration date, like the closest expiration date. But I prefer weekly expiration date.

The Big picture

Ideally most of us want to be financially free. We want to have a pool of money, a pool of assets big enough that we can live off of some the dividends or interest that the assets generate.

Also big enough that a portion of the dividends or interest that the assets generate can be reinvested so our pool of money grow even bigger.

So, how do we get there?

You can buy low and sell high, and hold for the long run and hopefully you get there.

That’s great, the problem is that we need money to invest. And most people have a 9-5 job, a wage slavery job. This job might not be enough to start investing.

So, we take some money from our 9-5 job and use it to trade. We all have to start some where.

By the way, before doing any investing or trading, make sure that you have enough to cover your living expenses. Also make sure that you have your emergency fund which will help you with your living expenses in case of an emergency.

Some people prefer to have an emergency fund of 3 months, others prefer 6 months, others 1 year or more. I prefer at least one year of living expenses cover with the emergency funds. call it childhood trauma if you want but I think is better to choose whatever bring you peace of mind.

Whatever is your choose, just make sure that is at least 3 month of emergency. It’s call emergency for a reason, because it’s not expected. So do not let it caught you off guard.

Anyway

That’s where the side hustle comes in. We need to start a side hustle and develop some kind of high income skill. So we can bring the Big $$$ so we have enough money to invest and get to our financial freedom goal faster.

Hence, you can pick any side hustle you want , I prefer the trading side hustle. This is where trading comes in.

We use option trading as a way to generate weekly income. With the weekly income you that you generated, you take a portion to increase your trading account and a portion to invest in the long run.

We become proficient at what we repeatedly practice. So as time passes, we’ll just get better and better a trading. And as we get better we can decide to try other things. Next thing you know you trading stocks, futures, options and the list go on.

That’s it.

Take a calculated risk.

Now, start and adjust as you go.

You might want to read This is for the people that find options complicated